“Using a stable source of earnings is very important for seniors to qualify for loans during retirement. Lenders want to ensure that retirees hold the monetary usually means to repay the loan.

Seniors with terrible credit rating could possibly be tempted to investigate riskier loan alternatives like credit card cash innovations and payday loans, but these options generally come with substantial fascination charges and costs.

Can seniors on Social Stability obtain a mortgage loan? Certainly, seniors on Social Protection can get a property finance loan. Lenders frequently look at Social Safety as a stable kind of profits. Even so, eligibility will likely count on other components like credit rating rating, other resources of cash flow, and current debts.

With above two yrs of experience writing within the housing marketplace Room, Robin Rothstein demystifies home loan and loan ideas, aiding initial-time homebuyers and homeowners make knowledgeable selections as they navigate the home loan Market.

In the event you’re a senior who depends on Social Stability as your Main source of profits, the considered securing a house loan may be complicated. Nevertheless, there are actually residence loans for seniors on Social Stability specifically intended to fulfill your exceptional economical requirements.

Kiah Treece is a little small business proprietor and personal finance expert with experience in loans, business enterprise and private finance, insurance coverage and real estate.

Nonetheless, it may be tougher for retirees and more info seniors to satisfy People qualifying criteria, especially regarding income.

Even though you not have task money, you may still qualify for many loans, offered you might have Social Security Rewards, a pension or a retirement fund.

Refinancing and equity guideToday's refinance ratesBest refinance lenders30-yr mounted refinance rates15-yr mounted refinance ratesBest income-out refinance lendersBest HELOC Lenders

There’s also no assure that you're going to retire when prepared. Many people alter their options according to the current economic system, their investments, or their desire to preserve working

Implement having a co-signer. Adding a creditworthy co-signer towards your software can assist you get authorized and obtain superior interest fees. Take into account that your co-signer will turn into Similarly to blame for the loan and missed payments will damage their credit score.

You'll be able to frequently total this entire system on-line, while some lenders Enable you to implement about the mobile phone or in particular person if you prefer to talk to a loan expert.

Property finance loan calculatorDown payment calculatorHow Considerably dwelling can I find the money for calculatorClosing costs calculatorCost of residing calculatorMortgage amortization calculatorRefinance calculator

Present-day mortgage loan rates30 yr home finance loan rates5-yr ARM rates3-yr ARM ratesFHA home loan ratesVA property finance loan ratesBest house loan lenders

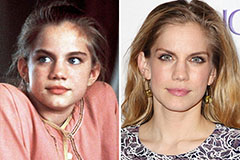

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!